Suppose the Variable Cost is $130 (and the Fixed Cost is $45,000 – our dressmaker can’t afford to have nice fabric plus get Ms. Madonna). Break-even also can be used to examine the impact of a potential change to the variable cost of producing a good. Performing break-even analysis is a crucial types of bookkeeper activity for making important business decisions and to be profitable in business. If the price stays right at $110, they are at the BEP because they are not making or losing anything. Options can help investors who are holding a losing stock position using the option repair strategy.

What Is the Breakeven Point (BEP)?

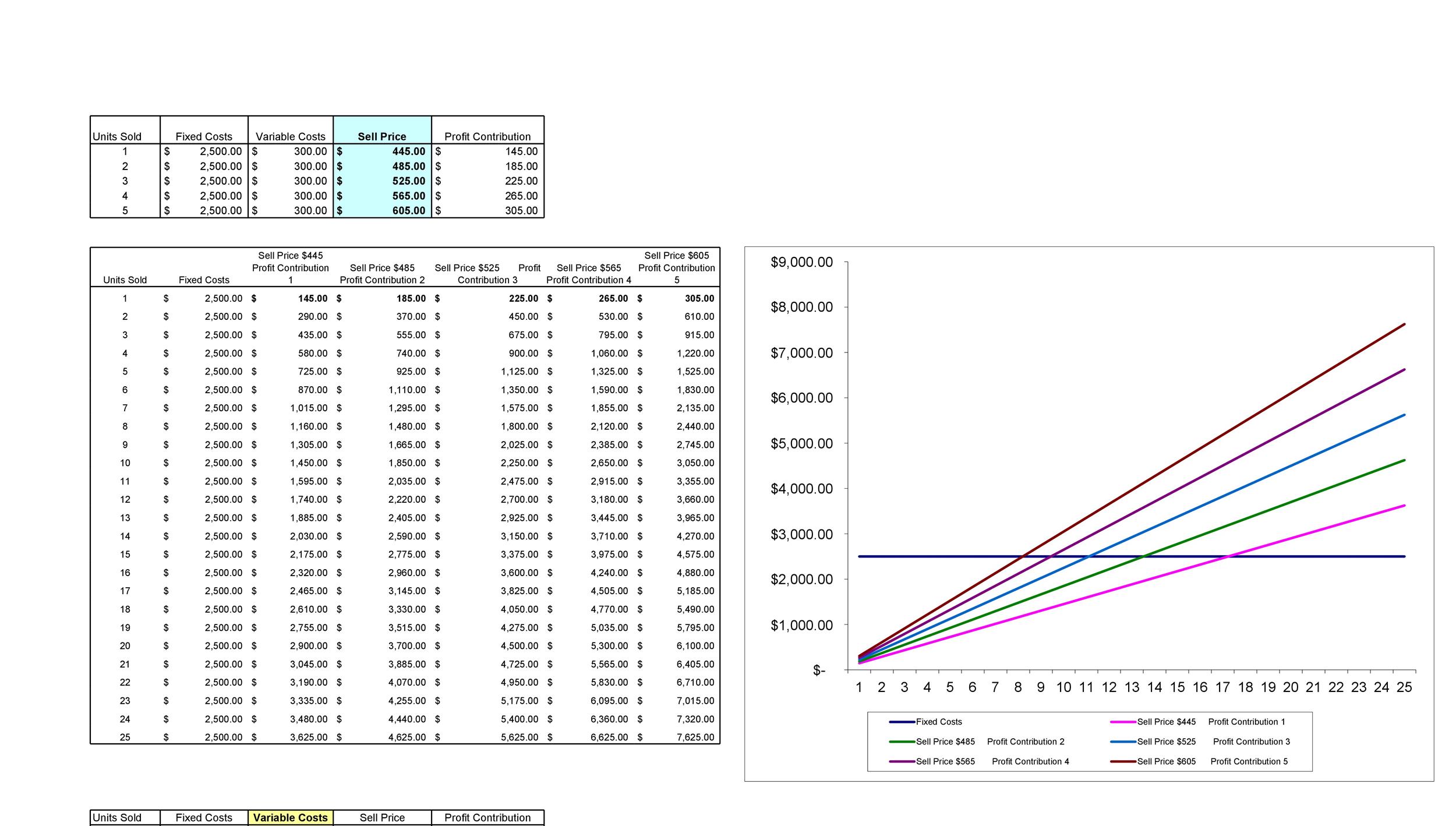

The units sold are plotted on the horizontal axis, while total revenue is shown on the vertical axis. As with most business calculations, it’s quite common that different people have different needs. For example, your break-even point formula might need to be accommodate costs that work in a different way (you get a bulk discount or fixed costs jump at certain intervals). Because your break-even point concerns the price relationship to your expenses, you can calculate different break-even points based on sold units or different pricing schemes.

How to Create a Break Even Chart in Excel for Your Business Expenses

In this guide, we’ll cover what a break-even point is, why it’s critical to calculate, how to calculate it, and additional factors you should consider. Break-even analysis formulas can help you compare different pricing strategies. Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Introducing a new product or service

Lastly, please understand that break-even analysis is not a predictor of demand. To start and sustain a small business it is important to know financial terms and metrics like net sales, income statement and most importantly break-even point. Andy Smith is a Certified Financial Planner (CFP®), licensed realtor and educator with over 35 years of diverse financial management experience. He is an expert on personal finance, corporate finance and real estate and has assisted thousands of clients in meeting their financial goals over his career. Break-even charts and P/V graphs are often used together to benefit from the advantages of both visualizations.

- These include start-up costs, and other capital expenses which do not have to be paid periodically.

- The analysis becomes more complex and less accurate if you offer a wide range of products with different price points and variable costs.

- The latter is a similar calculation, but it’s based around knowing how much you bring in over a certain period of time.

- However, you need to think about whether your customers would pay $200 for a table, given what your competitors are charging.

You can figure out your contribution margin ratio by taking the contribution margin per unit and dividing it by the sales price. The break-even point is the volume of activity at which a company’s total revenue equals the sum of all variable and fixed costs. The break-even point is the point at which there is no profit or loss. Assume a company has $1 million in fixed costs and a gross margin of 37%.

One major downside is its reliance on the assumption that costs can be neatly divided into fixed and variable categories. For example, semi-variable costs, which have both fixed and variable components, can complicate the accuracy of the breakeven calculation which then changes the breakeven point in units. Now, as noted just above, to calculate the BEP in dollars, divide total fixed costs by the contribution margin ratio. To find the total units required to break even, divide the total fixed costs by the unit contribution margin. Break-even analysis looks at internal costs and revenues, but doesn’t factor in external influences that can impact your business.

This analysis shows that any money generated over $200,000 will be net profit. Here are four ways businesses can benefit from break-even analysis. A break-even analysis can be used to continuously audit and fine-tune your pricing strategy. If you find sales are missing expectations, you can reference this calculation to easily understand what quantities must be sold if you decide to adjust the price. At the break-even point, you’ve made no profit, but you also haven’t incurred any losses. This metric is important for new businesses to determine if their ideas are viable, as well as for seasoned businesses to identify operational weaknesses.

It is useful only when the production is inside the relevant range i.e. output bracket in which fixed costs do not change. The break-even point is defined as the output/revenue level at which a company is neither making profit nor incurring loss. For a company to make zero profit, its total sales must equal its total costs.